Review of Comments on SEC Climate Rulemaking

Harvard Corporate Governance

NOVEMBER 23, 2022

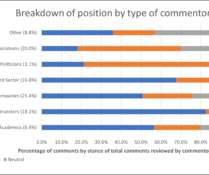

The review classified the major arguments used in each comment, but focused on arguments related to legal authority, Scope 3 emissions disclosures, and materiality and the 1% threshold. Investors are most supportive, followed by NGO/Third sector and then Companies. Least supportive are Trade Associations and Politicians.

Let's personalize your content