Return on Equity, Earnings Yield and Market Efficiency: Back to Basics!

Musings on Markets

FEBRUARY 18, 2025

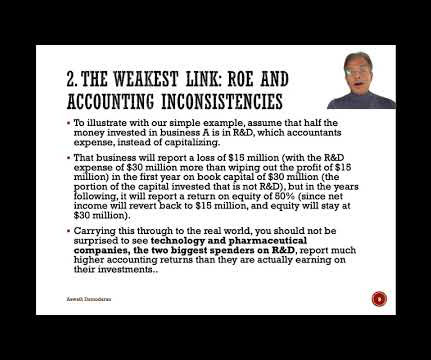

With these characteristics, the accounting balance sheets for these companies will be identical right after they start up, and the book value of equity will be $60 million in each company. In this example, for instance, business A, with a market value of equity of $150 million and a book value of equity of $60 million, will trade at 2.50

Let's personalize your content