Dark Accounting Matter

Harvard Corporate Governance

JULY 9, 2024

The S&P 500 currently trades at a price to book value of 4.2, suggesting that book value accounts for less than 20% of the S&P 500’s market value. more…)

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Harvard Corporate Governance

JULY 9, 2024

The S&P 500 currently trades at a price to book value of 4.2, suggesting that book value accounts for less than 20% of the S&P 500’s market value. more…)

Musings on Markets

FEBRUARY 18, 2025

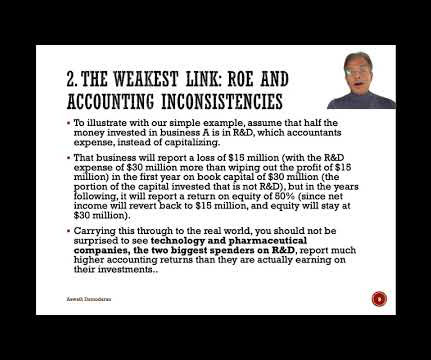

The second was a comment that I made on a LinkedIn post that had built on my implied equity premium approach to the Indian market but had run into a roadblock because of an assumption that, in an efficient market, the return on equity would equate to the cost of equity.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Equilest

DECEMBER 15, 2022

Market value and book value with two definitions of value. Market value or relevant market value for companies traded on various stock exchanges. That is, the market value expresses the value of all the company shares on a particular day. The reason is simple.

Equilest

OCTOBER 30, 2022

Have you wondered What is the Adjusted Book Value Method? With our "What is the Adjusted Book Value Method?" Does anyone really know what Adjusted Book Value Method is? What is the Adjusted Book Value Method? The adjusted book value approach is a valuation approach based on the balance sheet.

Equidam

APRIL 26, 2025

This approach encourages dialogue focused on the business fundamentals the team, the market opportunity, the product, the financial projections rather than anchoring the conversation to arbitrary figures potentially derived from selectively chosen, and often inappropriate, market comparisons.

Startup Valuation Blog

JULY 11, 2021

You can use this platform to conduct discounted cash flow, earnings multiples, and book value multiples valuation methods. This platform provides valuations for companies in 90 industries and 113 countries, which ensures that you can get the valuation results you need regardless of your location and target market.

RNC

MARCH 30, 2025

For a deeper understanding of alternative approaches, including NAVs role compared to earnings-based and market-based methods. The Net Asset Method is particularly suitable in scenarios where a companys primary value is derived from its tangible assets rather than future earnings potential. When Should You Use the Net Asset Method?

Viking Mergers

MAY 18, 2023

With that kind of earnings potential, you may expect it to be a seller’s market with buyers lined up to take advantage of e-commerce popularity. A professional valuation will provide vital insight into where your business fits in the broader industry and global e-commerce market.

IVSC

FEBRUARY 7, 2022

Jeremy chairs the Corporate Reporting Users’ Forum (CRUF) UK and co-chairs the Capital Markets Advisory Committee (CMAC), which is one of the advisory groups of the International Financial Report Standards (IFRS) Foundation. ” The value of a smile. In the past, market valuations often mirrored the reported balance sheet.

Musings on Markets

JULY 17, 2023

I am not a market prognosticator for a simple reason. I am just not good at it, and the first six months of 2023 illustrate why market timing is often the impossible dream, something that every investor aspires to be successful at, but very few succeed on a consistent basis.

Musings on Markets

JULY 22, 2021

Zomato, an Indian online food-delivery company, was opened up to public market investors on July 14, 2021, and its market debut is being watched for clues by a number of other online ventures in India, waiting in the wings to go public.

Benzinga

OCTOBER 8, 2024

The stock market's insatiable appetite for high-growth stories often leaves a trail of undervalued opportunities in its wake. Blue-chip stocks are the corporate world's stalwarts and frequently get overshadowed by the allure of the latest market darlings. Its current P/E ratio of 17.65 sits below the industry average of 38.5,

Musings on Markets

JANUARY 10, 2025

In corporate finance and investing, which are areas that I work in, I find myself doing double takes as I listen to politicians, market experts and economists making statements about company and market behavior that are fairy tales, and data is often my weapon for discerning the truth. Standard Deviation in Equity/Firm Value 2.

Musings on Markets

OCTOBER 6, 2023

A few days ago, I valued Instacart ahead of its initial public offering , and noted that the reception that the stock gets will be a good barometer of where risk capital stands in the market, right now. That would suggest that intangible assets are being valued and incorporated into balance sheets much more now than in the past.

BV Specialists

AUGUST 14, 2023

A Business Appraisal relies on three broadly accepted approaches that consider all the potential variables that factor into a valuation: The Income Approach, Market Approach, and Asset Approach. These approaches review and analyze historic performance, reasonable growth projections, and the underlying assets of a company to estimate value.

Peak Business Valuation

SEPTEMBER 17, 2024

At Peak Business Valuation , we frequently use the asset approach when valuing a small business. A common method under the asset approach is The Adjusted Book Value Method. This asset approach involves adjusting the book value of a company’s assets and liabilities to reflect their current market values.

Valutico

MAY 19, 2025

The core idea behind relative valuation is to estimate a company’s value by comparing it to similar companies based on how the market prices their financial metrics. The multiple is calculated as Enterprise Value (EV) divided by EBITDA. EV/EBITDA is a widely used multiple in this relative valuation approach.

Musings on Markets

AUGUST 19, 2024

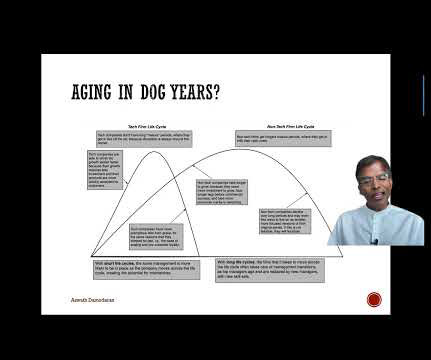

The second is to look at the industry group or sector that a company is in, and then follow up by classifying that industry group or sector into high or low growth; for the last four decades, in US equity markets, tech has been viewed as growth and utilities as mature.

Equilest

NOVEMBER 1, 2022

Have you wondered What is the Adjusted Book Value Method? With our "What is the Adjusted Book Value Method?" Does anyone really know what Adjusted Book Value Method is? What is the Adjusted Book Value Method? The adjusted book value approach is a valuation approach based on the balance sheet.

Chris Mercer

MARCH 8, 2023

This post provides a discussion of several implications of the definition of the standard of value known as fair market value. We focus first on the definition of fair market value. We then look at the implications for the so-called “marketability discount for controlling interests.”

Musings on Markets

JANUARY 5, 2024

Thus, looking at only the companies in the S&P 500 may give you more reliable data, with fewer missing observations, but your results will reflect what large market cap companies in any sector or industry do, rather than what is typical for that industry.

Shuster & Co.

DECEMBER 15, 2021

An overview of some of the top methods CPAs use to determine a business’ value include: Market Value Method/Comparable Company Analysis. The market value method is one of the most subjective ways to value a business. The value is based on the net cash that would be generated from the sale of assets.

Sun Acquisitions

OCTOBER 13, 2023

Valuation techniques in M&A involve a comprehensive assessment of financial, operational, and market factors. Market-Based Valuation One widely used valuation technique in M&A is market-based valuation. Asset-Based Valuation Asset-based valuation determines the worth of a company by considering its net asset value (NAV).

Appraisal Rights

MAY 19, 2022

Appraisal Rights and Fair Value as Investor Protection: A Needed Brazilian Reform. The current Brazilian Corporation Law (Law nº 6.404 of 1976) sets book value as the standard method to define the share value, even in the case of a listed company.

Benzinga

JUNE 16, 2023

Customers Bancorp (NYSE: CUBI ) has acquired a $631 million venture banking loan portfolio from the FDIC at ~85% of book value. CUBI also hired 30 team members from the loan origination group to support the venture-backed growing industry from seed to late-stage. Full story available on Benzinga.com

Startup Valuation Blog

NOVEMBER 16, 2021

It offers a variety of tools: Business valuation software: The software enables the building of financial models, to be used to evaluate a business using discounted cash flow, earnings multiples, and book value multiples, and more. Pitch Deck Creator. ? Cap Table Management. Affordable Price.

RNC

FEBRUARY 5, 2024

Introduction: A mid-sized EPC company in India, specializing in infrastructure projects is undergoing a thorough business valuation to ascertain its fair market value for potential strategic partnerships, mergers, or acquisitions. Questions Arise: How to value a complex project mix with varying risk profiles and revenue streams?

Benzinga

JULY 18, 2023

stake in Wella for $150 million, reflecting a 4% premium to the book value of Wella as of March 31, 2023. Coty Inc (NYSE: COTY ) has entered into a binding letter of intent to sell a portion of its Wella beauty and hair care brand stake to investment firm IGF Wealth Management. Coty will sell a 3.6%

Musings on Markets

FEBRUARY 27, 2022

That said, about 31% of the net profits of all publicly traded firms listed globally in 2021 were generated by financial service firms; that percent is lower in the US and higher in emerging markets. To make comparisons, profits are scaled to common metrics, with revenues and book value of investment being the most common scalar.

Musings on Markets

JANUARY 31, 2024

For decades, the notion of maximizing value has been central to corporate finance, though there have been disagreements about whether maximizing stock prices would get you the same outcome, since that latter requires assumptions about market efficiency.

Valutico

SEPTEMBER 22, 2023

There are three primary approaches under which most valuation methods sit, which include the income approach, market approach, and asset-based approach. The income approach estimates value based on future earnings, using techniques like the discounted cash flow analysis. How Do I Value a Business?

Benzinga

JUNE 13, 2024

Pathfinder expects the acquisition to generate a favorable internal rate of return and attractive earnings per share accretion, all within a reasonable tangible book value earn back period. This acquisition significantly increases our presence in the attractive Syracuse market and further positions us for accelerated business growth.

Benzinga

JULY 26, 2023

PacWest's tangible book value had been improving since widespread banking issues rocked the industry earlier this year. Wedbush Wedbush analyst David Chiaverini views the business combination as fair, but not "overwhelmingly attractive" for PacWest shareholders.

BV Specialists

JANUARY 3, 2022

Business owners likely have particular ideas about the value of their company and how best to calculate it, given their experience and knowledge of their financial history, and understanding of the market and industry in which they operate. Market Approach. >The Asset Approach.

Equilest

FEBRUARY 24, 2024

Market-Based Business Valuation Formula For a market-based calculation, use: CV = (EBITDA x 1.5) – (Current Liabilities x 0.5) Or V = (EBITDA * 1.3) / (Revenue – COGS) As an example, if a business's EBITDA is $300,000 and current liabilities are $50,000, the calculation would be: ($300,000 x 1.5) - ($50,000 x 0.5) = $425,000.

RNC

OCTOBER 1, 2024

It’s a crucial factor in determining the value of an investment. Investors and analysts assess a company’s worth using various methods that consider its earnings, assets, and market conditions. Price-to-Book Ratio (P/B) This ratio compares a company’s market value to its book value (assets minus liabilities).

Benzinga

MAY 26, 2022

billion Expected to be accretive to earnings per share in year one Earn back of tangible book value dilution in approximately three years. OTC Markets: LBSI) ("Liberty"), the holding company for Liberty National Bank, jointly announced today that they have entered into an Agreement and Plan of Reorganization (the "Agreement").

Shuster & Co.

AUGUST 15, 2023

And even if the number is close to market value, others may perceive a bias. The valuation process may incorporate different methods for determining a company’s value. Therefore, an objective business valuation is often required from a third party.

Equilest

JANUARY 11, 2024

Net Identifiable Assets This encompasses the total value of assets owned by the acquired company, minus its liabilities. Tangible and intangible assets find a home here, reflecting their book value on the target company's balance sheet. Essentially, it signifies the disparity between fair market value and purchase price.

Benzinga

MARCH 4, 2024

Pathfinder expects the acquisition to generate a favorable internal rate of return and attractive earnings per share accretion, all within a reasonable tangible book value earn back period. On a pro forma basis, following the branch acquisition, Pathfinder's total assets will approximate $1.7

Equilest

JULY 3, 2024

Business valuation is the process of determining the economic value of a business or company. It's a way to measure what your business is worth in the market, considering various factors and using different methods. Liquidation Value Determines the worth if the business assets were sold off quickly, often lower than book value.

Benzinga

MAY 4, 2022

The proposed transaction will expand Seacoast's presence into new and growing Florida markets including Ocala and Gainesville. The proposed transaction is a natural continuation of Seacoast's M&A strategy and adds a stable, high-quality franchise in growing markets. Shaffer, Seacoast's Chairman and CEO.

Benzinga

MARCH 29, 2022

The proposed transaction, a natural continuation of Seacoast's M&A strategy, adds a premier, high-quality Miami banking franchise and a leadership team with deep relationships and experience in this financially attractive market. Following the merger, Arriola will remain with Seacoast, serving as Miami-Dade Market Executive.

Farrel Fritz

FEBRUARY 14, 2022

million, or 59% [of Quattro], and the value of those shares at the time of breach” (citing Emposimato v CICF Acquisition Corp. , Garibaldi valued Quattro using an asset approach based upon its “book value” as stated in its financial statement and tax return for the period ended December 31, 2015. million shares.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content