Data Update 7 for 2023: Dividends, Buybacks and Cash Flows

Musings on Markets

MARCH 8, 2023

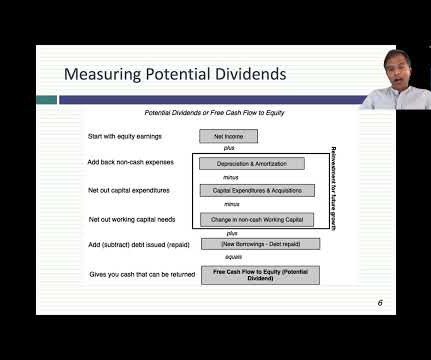

This is the last of my data update posts for 2023, and in this one, I will focus on dividends and buybacks, perhaps the most most misunderstood and misplayed element of corporate finance. Viewed in that context, dividends as just as integral to a business, as the investing and financing decisions.

Let's personalize your content