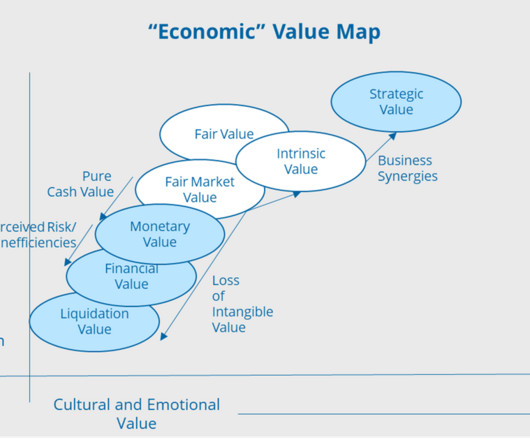

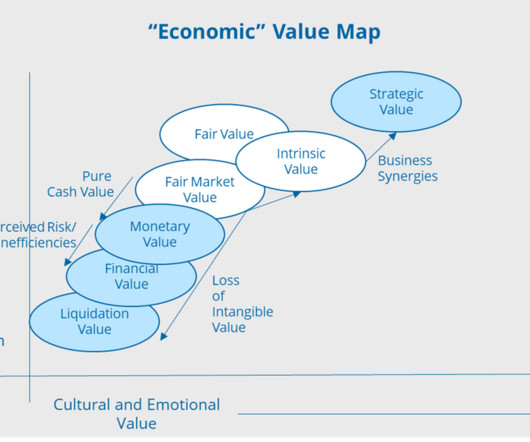

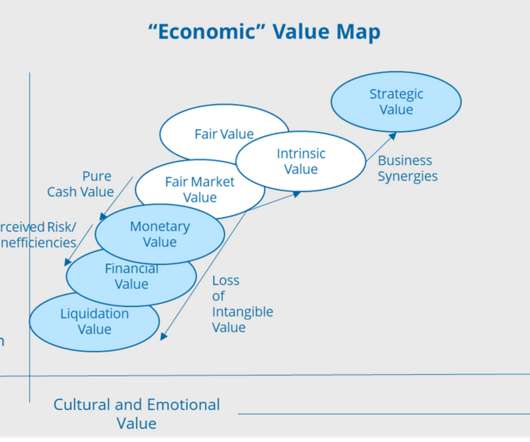

Transcending Value – Liquidation, Monetary, Financial, and Strategic Value

Value Scope

JUNE 2, 2021

Valuation necessarily requires an understanding and deep insight into accounting, economics, and finance. To the typical private equity group (“PEG”), financial value rules – buy low and sell high. If you liked this blog you may enjoy reading some of our other blogs here.

Let's personalize your content