Strategic Insights: Valuing Assets in Complicated Deals

RNC

NOVEMBER 2, 2023

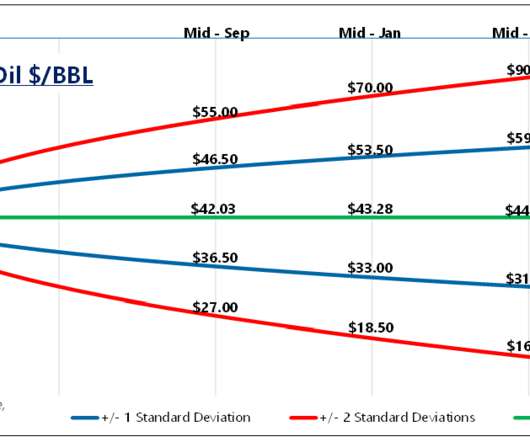

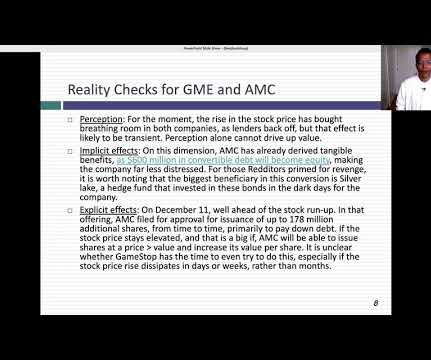

In this blog, we’ll examine the nuances of valuing assets in intricate transactions and talk about the crucial processes to arrive at an accurate company valuation. Financial Strategy: Valuation is a key component in developing financial strategy and informing decisions about the company’s future.

Let's personalize your content