Need to Value Your Blog Site? Avoid This!

Equilest

NOVEMBER 6, 2022

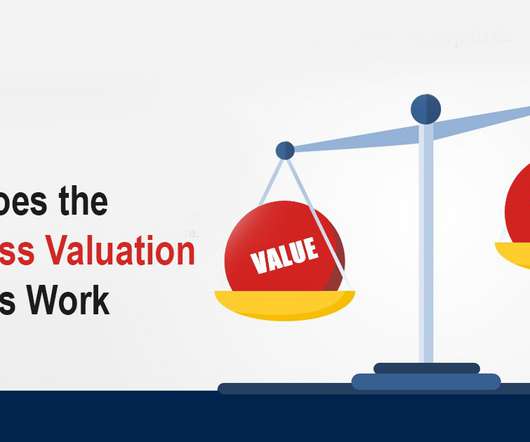

Have you wondered how you can evaluate your blog site? Recently I came across this Linkedin Post following reference: "I own a blog worth $59,417-$72,634. Average Monthly Profit x Monthly Multiple = Valuation. . My blog currently: . - $1,872/mo profit (last 12-month average). A Relative Valuation Approach - What is it?

Let's personalize your content