Investment Giant BlackRock's Strong Finish To 2023: Dividend Boost, Accretive Acquisition & More

Benzinga

JANUARY 12, 2024

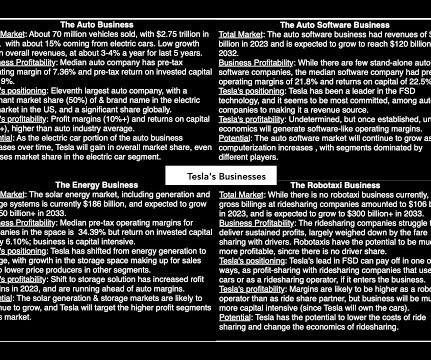

billion a year ago, led by market beta on average AUM, positive organic base fee growth, and higher securities lending revenue. Technology services revenue increased to $379 million from $353 million the prior year, reflecting the onboarding of several large clients. billion from $3.40

Let's personalize your content