MiddleGround Capital Completes Acquisition of Spain-Based Global Engineering Service Provider IT8

Benzinga

MARCH 7, 2024

LEXINGTON, Ky.,

Benzinga

MARCH 7, 2024

LEXINGTON, Ky.,

Benzinga

JUNE 15, 2023

June 15, 2023 (GLOBE NEWSWIRE) -- MiddleGround Capital , an operationally focused private equity firm that makes control investments in middle market manufacturing B2B industrial and specialty distribution companies globally, today announced it has acquired A.M. LEXINGTON, Ky., Castle & Co.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

FE International

APRIL 13, 2022

At the lower end of the market, individuals are still leaving their jobs to buy businesses and, at the higher end, institutional investors and private equity firms have more capital available than ever before. B2B vs. B2C. More protection and control over your SaaS means increased opportunities for growth and expansion.

Class VI Partner

MAY 25, 2022

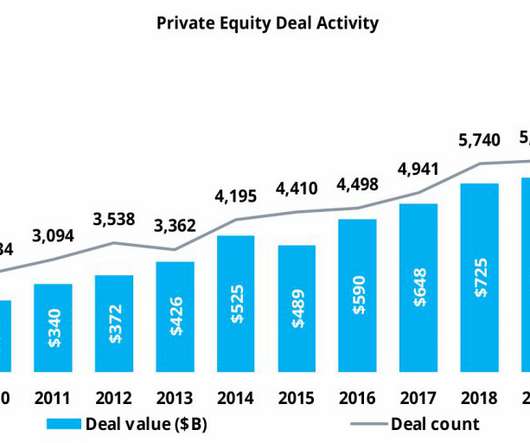

2021 Private Equity M&A Recap 2022 Deal Activity, Lender Environment and Outlook Conclusion. 2021 private equity deal activity was record-breaking by nearly every metric. private equity deals surpassed $1 trillion for the first time ever and marked a whopping 83% dollar-value growth rate over 2020.

FE International

APRIL 27, 2022

Taking a closer look at deals we closed in 2021, we see deals by sector spread across B2B Services/Products/Reviews, education and health and fitness, each with 14% of the deals. When we partnered with FE, they got us in front of leading private equity firms and strategics,” Ted Mikulski, the founder of Newor Media, said. “I

Let's personalize your content