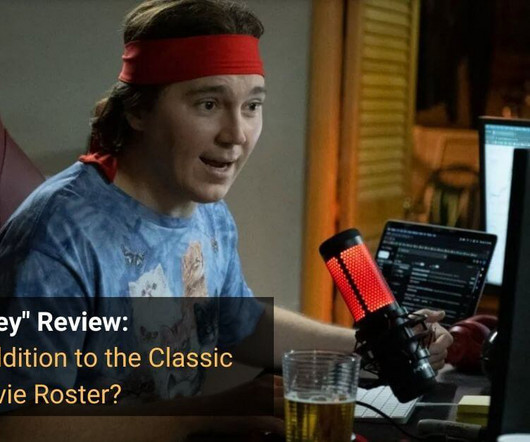

“Dumb Money” Review: A Worthy Addition to the Classic Finance Movie Roster?

Brian DeChesare

OCTOBER 4, 2023

Unfortunately, my initial instincts are often correct: If I have a bad feeling about something, it usually has issues. But the story is thin, there’s no real character development, and even if you ignore these issues, the filmmakers do a poor job of explaining the GameStop story. I wrote many articles about it.

Let's personalize your content