Can Salesforce return to its former lofty heights, after slumping 50% from its all time high?

Valutico

DECEMBER 6, 2022

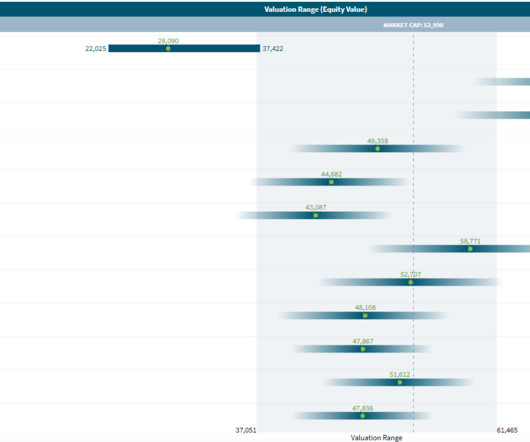

The current price of $133 represents a market capitalization of $145 billion. At the current level Salesforce has a P/E ratio of 100x and an EV/EBITDA ratio of 47x for 2022. This was mainly driven by operating expenses growth exceeding sales growth and thus putting strain on EBITDA margin. Link to detailed valuation.

Let's personalize your content