ESG Ratings: A Compass without Direction

Harvard Corporate Governance

AUGUST 24, 2022

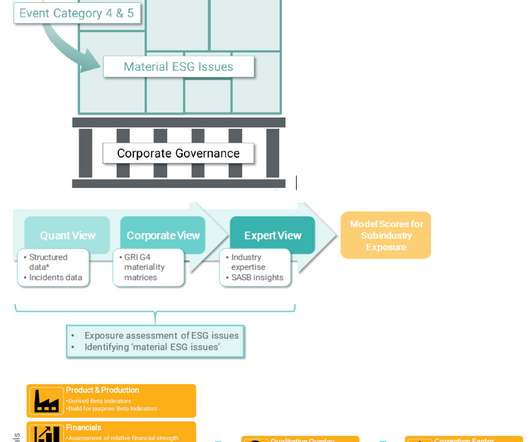

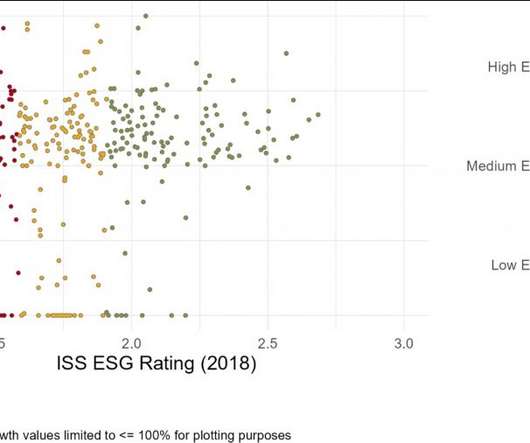

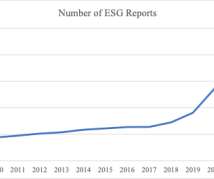

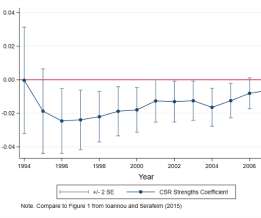

ESG ratings are intended to provide information to market participants (investors, analysts, and corporate managers) about the relation between corporations and non-investor stakeholders interests. Recently, ESG ratings providers have come under scrutiny over concerns of the reliability of their assessments. Strine, Jr.;

Let's personalize your content