Sovereign Ratings, Default Risk and Markets: The Moody's Downgrade Aftermath!

Musings on Markets

JUNE 2, 2025

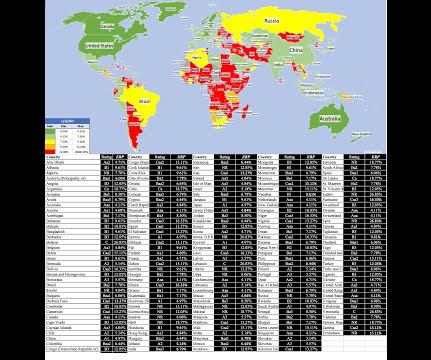

The decade from 1985 to 1994 added 34 countries to the sovereign rating list, with many of them having speculative or lower ratings and by 2024, Moody's alone was rating 143 countries, covering 75% of all emerging market countries and almost every developed market. for investment grade (Aaa to Baa1) sovereign debt.

Let's personalize your content