Country Risk 2025: The Story behind the Numbers!

Musings on Markets

JULY 31, 2025

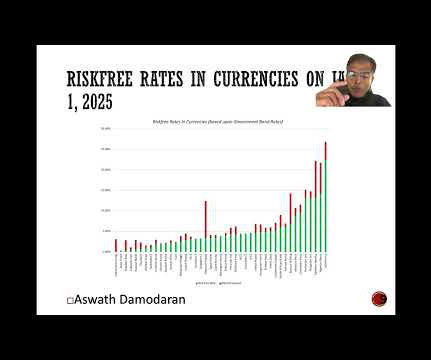

At the start of July, I updated my estimates of equity risk premiums for countries, in an semiannual ritual that goes back almost three decades. To estimate the cost of equity for an investment in a risky country. As with some of my other data updates, I have mixed feelings about publishing these numbers.

Let's personalize your content