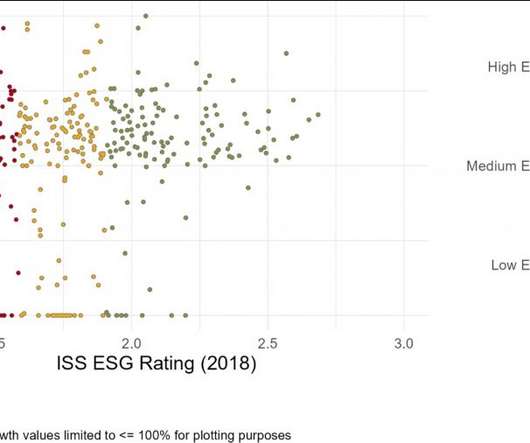

Can High ESG Ratings Help Sustain Dividend Growth?

Harvard Corporate Governance

AUGUST 18, 2022

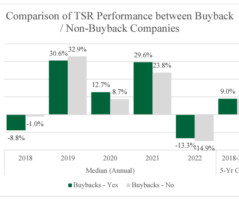

on Thursday, August 18, 2022 Editor's Note: Subodh Mishra is Global Head of Communications at Institutional Shareholder Services, Inc. For many, investing in the current market environment can be described as navigating uncharted waters. The 2018 and 2021 dividends are used to calculate a three-year dividend growth rate.

Let's personalize your content