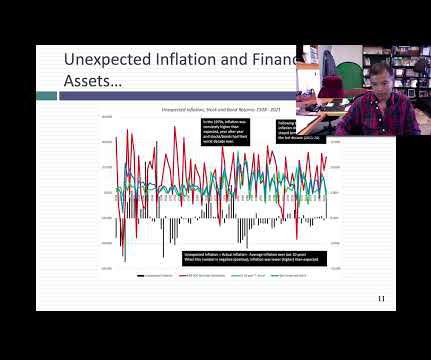

Data Update 3: Inflation and its Ripple Effects!

Musings on Markets

JANUARY 27, 2022

Inflation numbers have been coming in high now, for more than a year, but for much of the early part of 2021, bankers, investors and politicians seemed to be either in denial or casually dismissive of its potential for damage.

Let's personalize your content