A Zomato 2022 Update: Value, Pricing and the Gap

Musings on Markets

JULY 27, 2022

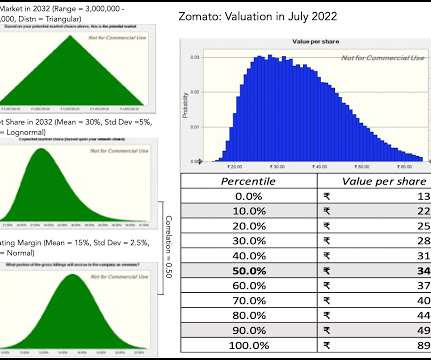

On July 21, 2021, I valued Zomato just ahead of its initial public offering at about ? 169 per share in late 2021. per share, and the mood and momentum that worked in its favor for most of 2021 had turned against the company. 15,000 in March 2021 to ? 41 per share. 2000 per share, and the stock is currently trading at ?

Let's personalize your content