Data Update 5 for 2023: The Earnings Test

Musings on Markets

FEBRUARY 15, 2023

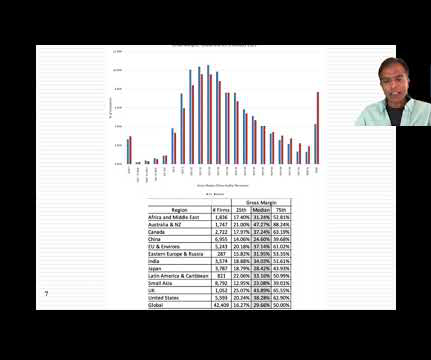

The first is to see how the increase in inflation in 2021 and 2021 has played out in profitability for companies, since inflation can increase profits for some firms, and lower them for others. the returns you can make on investments of equivalent risk, and that game became a lot more difficult to win in 2022.

Let's personalize your content