Can Salesforce return to its former lofty heights, after slumping 50% from its all time high?

Valutico

DECEMBER 6, 2022

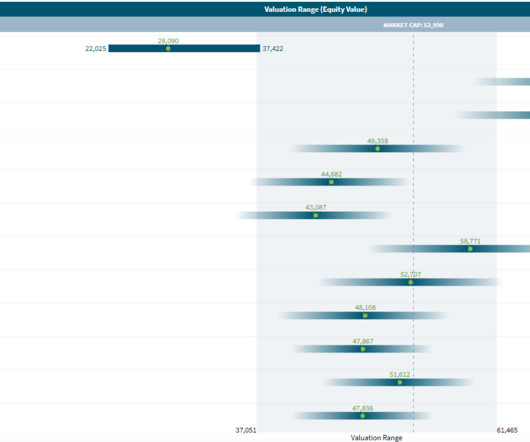

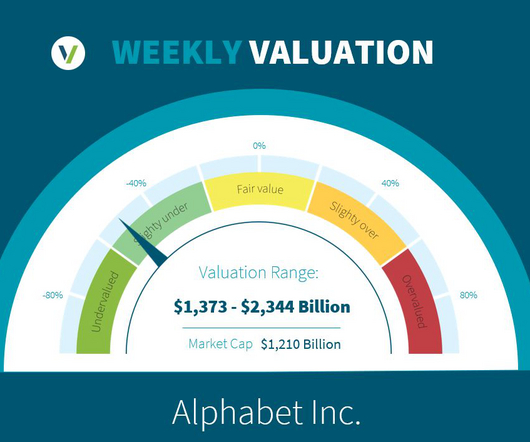

The market leader for CRM software is currently trading at around $133 per share, down more than 50% from its all-time-high of $300 per share, achieved in November 2021. . billion, an increase of 14% compared to Q3 in 2021. The current price of $133 represents a market capitalization of $145 billion.

Let's personalize your content