Data Update 2 for 2022: US Stocks kept winning in 2021, but…

Musings on Markets

JANUARY 19, 2022

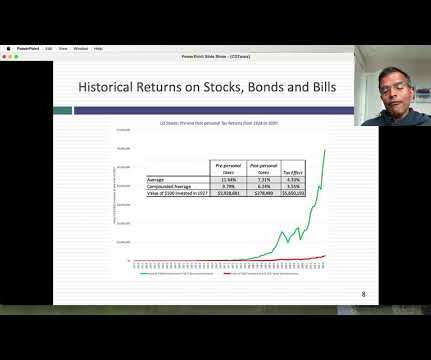

If equity markets surprised us with their resilience in 2020, not just weathering a pandemic for the ages, but prospering in its midst, US equity markets, in particular, managed to find light even in the darkest news stories, and continued their rise through 2021. The year that was.

Let's personalize your content