Data Update 2 for 2023: A Rocky Year for Equities!

Musings on Markets

JANUARY 21, 2023

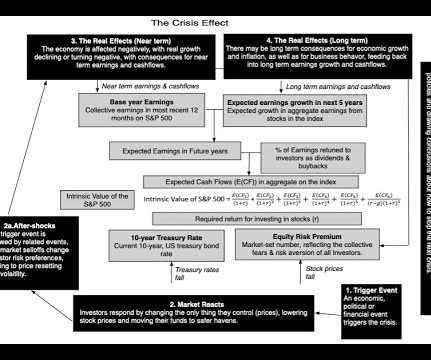

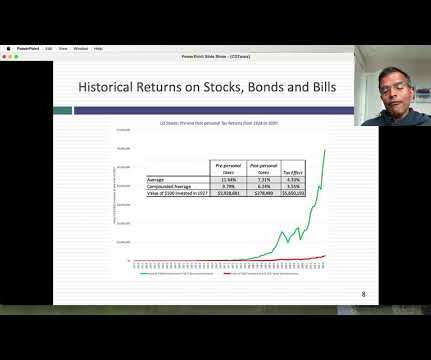

It is the nature of stocks that you have good years and bad ones, and much as we like to forget about the latter during market booms, they recur at regular intervals, if for no other reason than to remind us that risk is not an abstraction, and that stocks don't always win, even in the long term.

Let's personalize your content