Data Update 2 for 2023: A Rocky Year for Equities!

Musings on Markets

JANUARY 21, 2023

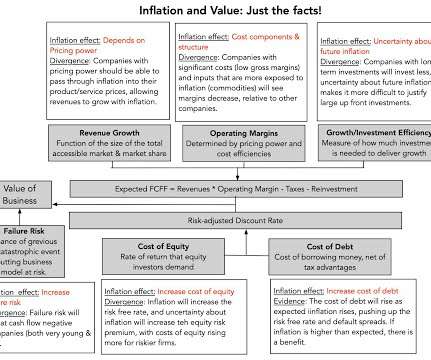

While there are many events during 2022, some political and some economic, that one can point to as the reason for poor stock returns, it is undeniable that inflation was the driving force behind the market correction. In this section, I will begin with a deconstruction of stock returns in 2022 and the year's place in stock market history.

Let's personalize your content