HSBC: Chance for Success or Misstep?

Valutico

MARCH 20, 2023

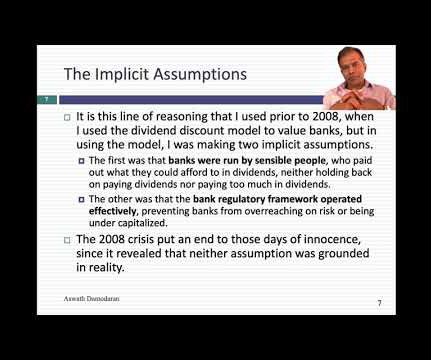

Recent Financial Performance In late February 2023, HSBC released its 2022 annual results, showing strong financial performance and higher capital distributions. They announced a 50% dividend payout ratio projected for 2023 and 2024 as well as a return to quarterly dividends from Q1 this year.

Let's personalize your content