Do Activists Beat the Market?

Harvard Corporate Governance

AUGUST 1, 2023

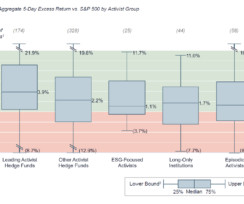

Specifically, since 2018, the market has reacted positively to new activist situations, with attractive short-term share price outperformance, but relatively few activists have been able to sustain market-beating performance throughout the first year following a campaign launch. corporations are managed.

Let's personalize your content