Financial Implications of Rising Political Risk in the US

Harvard Corporate Governance

SEPTEMBER 15, 2023

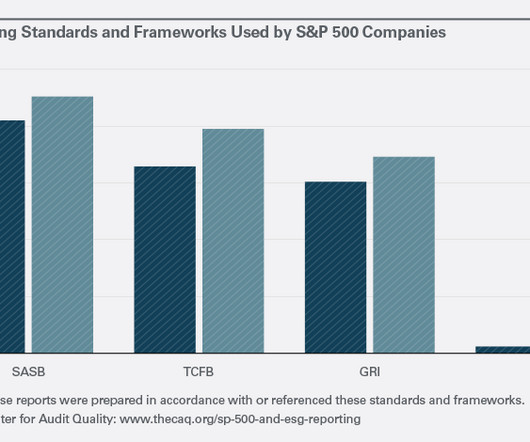

Calls to overturn elections and limit voting in the US are having a powerful, long-term, but under-the-radar impact on the financial world. First hard evidence surfaced on August 1 2023, when Fitch Ratings downgraded the US’s credit level, citing deteriorating governance standards. more…)

Let's personalize your content