Themes from Q3 Earnings Calls

Auto Dealer Valuation Insights

NOVEMBER 10, 2023

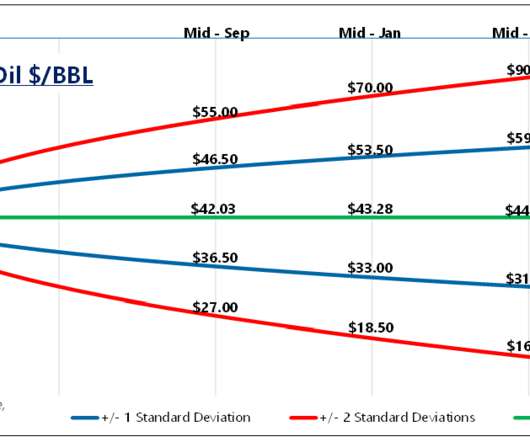

In Themes from Q2 2023 Earnings Calls, we noted E&P operators’ search for ways to maintain production levels, expectations for low crude oil inventories, and decreased activity in the Haynesville shale region. Despite the ongoing high-interest rate environment, one of the most significant topics in upstream earnings.

Let's personalize your content