ESG Reporting for Private Companies

Harvard Corporate Governance

SEPTEMBER 13, 2023

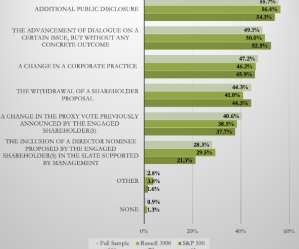

As we have noted in our previous report , environmental, social and governance (ESG) issues have garnered significant attention from a variety of stakeholders, resulting in increased reporting by many companies. In addition, the overview outlines some steps that such a private company can take to begin its ESG journey.

Let's personalize your content