The Board’s Oversight of Employee Voice

Harvard Corporate Governance

APRIL 21, 2023

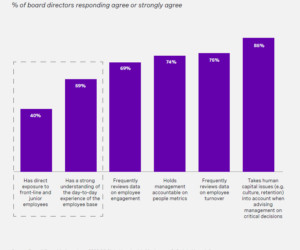

We reconvened in 2022 to research a topic of increasing importance: board oversight of human capital management, with a specific focus on employee voice. We define “employee voice” as the perspectives, interests, and needs of the workforce.

Let's personalize your content