Investment Advisers and Sponsors Compliance Policies: Hot Topics

Harvard Corporate Governance

MAY 11, 2024

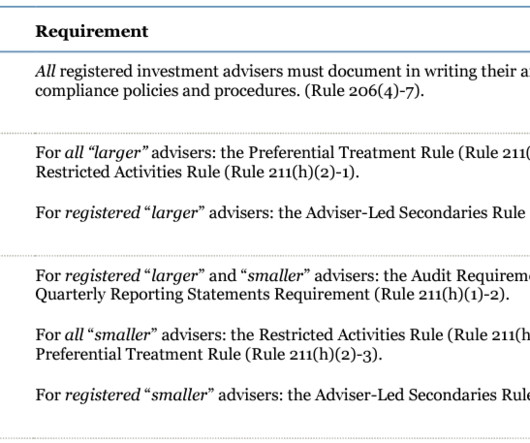

To that end, we provide a non-exhaustive list of hot topics to consider below, including with context from SEC examinations and SEC enforcement settlements. With Form ADV season in the rear view mirror, we recommend that sponsors turn to refreshing their compliance policies to align with rapidly evolving regulatory expectations.

Let's personalize your content