How Governance Professionals Are Guiding Corporate Disclosure on E&S Topics

Harvard Corporate Governance

AUGUST 7, 2023

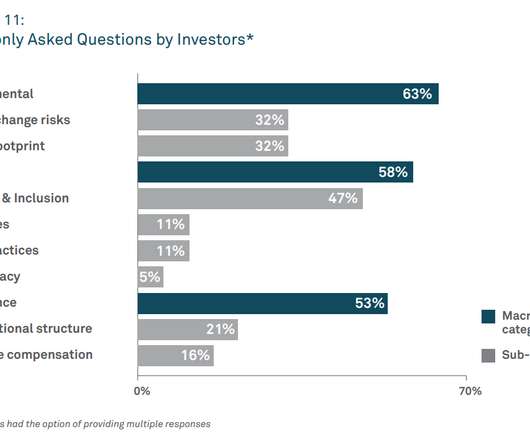

Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here ) by Lucian A. They raised corporate sustainability and social responsibility disclosures, as well as the role of ratings in reputation and risk management, as key topics. Strine, Jr.

Let's personalize your content