The Board’s Oversight of Employee Voice

Harvard Corporate Governance

APRIL 21, 2023

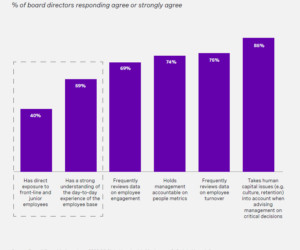

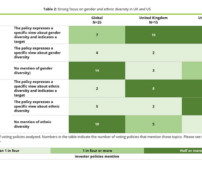

In July 2021, State Street Global Advisors, Russell Reynolds Associates, and the Ford Foundation partnered to study best practices for effective board oversight of racial and ethnic diversity, equity, and inclusion (“ The Board’s Oversight of Racial and Ethnic Diversity, Equity, and Inclusion ”).

Let's personalize your content