What boards should know about balancing ESG critics and key stakeholders

Harvard Corporate Governance

APRIL 9, 2023

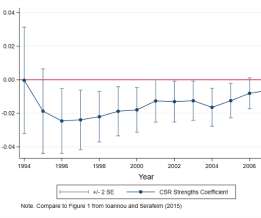

Environmental, social and governance (ESG) topics are often discussed as if there is a collective understanding about what they mean. The use of ESG as an umbrella term for so many topics has led to misperceptions and, at times, controversy about whether focusing on certain risks and opportunities violates duties to investors.

Let's personalize your content