Seller Protection With an Earnout

Benchmark Report

MARCH 7, 2022

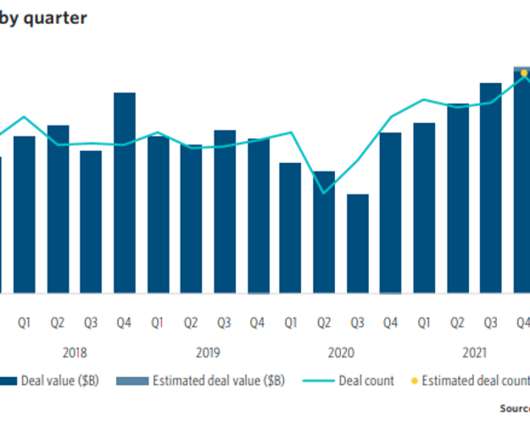

Earnout Agreements have become increasingly routine in deal structures over the last several years as they are most widely used during times of political and/or economic uncertainty. The earnout payment is additional compensation paid in the future to the seller after the business is sold. to be excluded from the calculation.

Let's personalize your content