The SEC and CFTC Overhaul Form PF

Harvard Corporate Governance

MAY 1, 2024

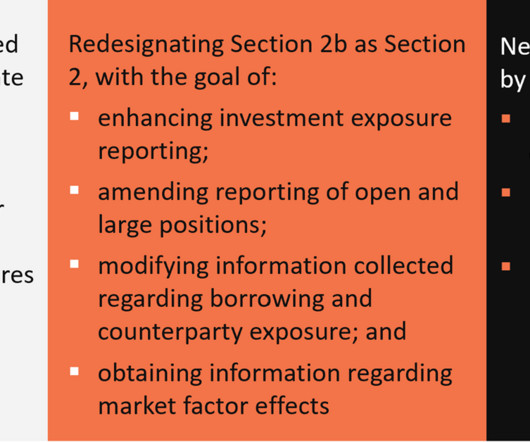

The US Securities and Exchange Commission (“SEC”) and the Commodity Futures Trading Commission (“CFTC”) have overhauled Form PF and private fund managers have until March 12, 2025, to begin reporting on the new Form. 2] The Form PF Amendments were jointly adopted by the SEC and CFTC on Feb. from private fund advisers. and amendments.

Let's personalize your content