Is your tax department spending more time and money because of audits?

ThomsonReuters

NOVEMBER 29, 2023

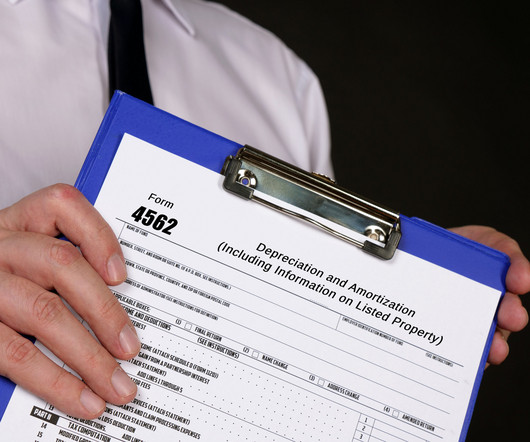

Most tax professionals know that dealing with forces beyond their control—and the costly disruptions they cause—is a way of life. Unfortunately, many tax departments are feeling a strain on their resources as a result of these events. This, in turn, puts tax departments at greater risk for even more audits and stiffer penalties.

Let's personalize your content