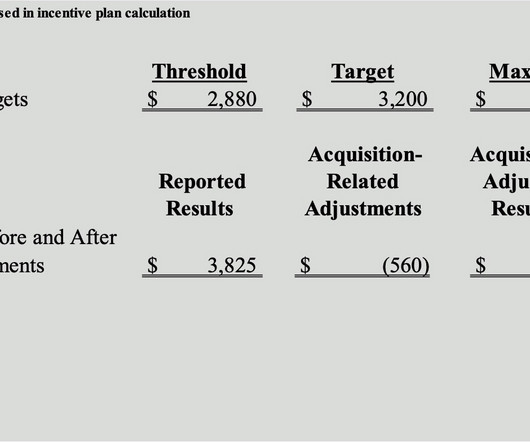

Non-GAAP Adjustments: Impact of Merger and Acquisition Activity on Performance Targets and Results

Harvard Corporate Governance

JANUARY 27, 2024

Introduction One of the more complex issues when measuring performance for incentive plan purposes is how to consider the effect of mergers, acquisitions, dispositions, and the related transaction costs (M&A activity) on financial performance during the performance period. This post is based on their Pay Governance memorandum.

Let's personalize your content