How To Prepare for Cyber Disclosures In a New Era of Transparency

Harvard Corporate Governance

AUGUST 17, 2023

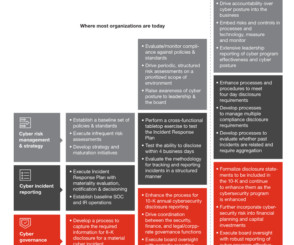

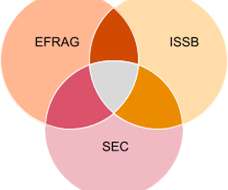

The revisions from the proposed rule have streamlined the disclosure requirements in many ways, in response to more than 150 comment letters filed from issuers, investors, and other parties. Still, disclosure can seem a daunting prospect if your company’s cybersecurity program won’t withstand investor scrutiny.

Let's personalize your content