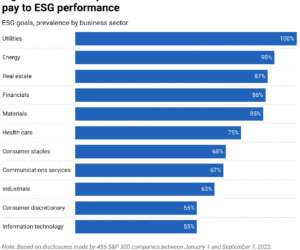

Linking Executive Compensation to ESG Performance

Harvard Corporate Governance

NOVEMBER 27, 2022

Related research from the Program on Corporate Governance includes The Perils and Questionable Promise of ESG-Based Compensation (discussed on the Forum here ) by Lucian A. At the same time, there are concerns about the benefits of incorporating ESG measures into compensation, the risks of doing so (e.g., Insights for What’s Ahead.

Let's personalize your content