Data Update 1 for 2025: The Draw (and Danger) of Data

Musings on Markets

JANUARY 10, 2025

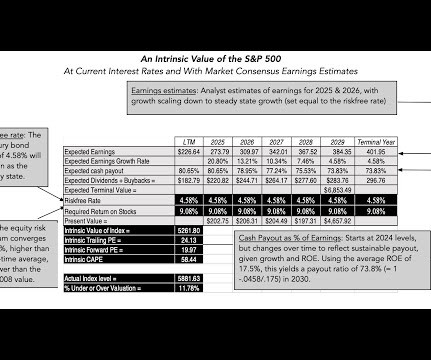

Thus, as you peruse my historical data on implied equity risk premiums or PE ratios for the S&P 500 over time, you may be tempted to compute averages and use them in your investment strategies, or use my industry averages for debt ratios and pricing multiples as the target for every company in the peer group, but you should hold back.

Let's personalize your content