Understanding Valuation under IBC: A Comprehensive Guide

RNC

MAY 26, 2025

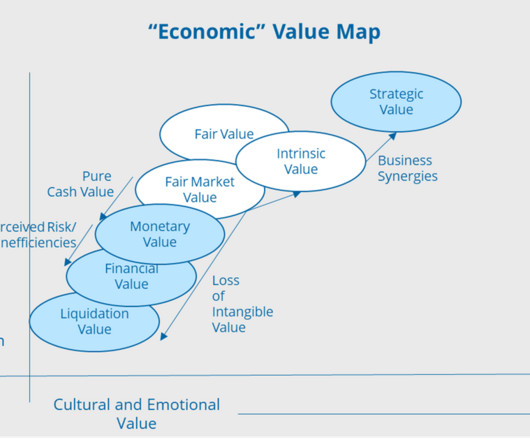

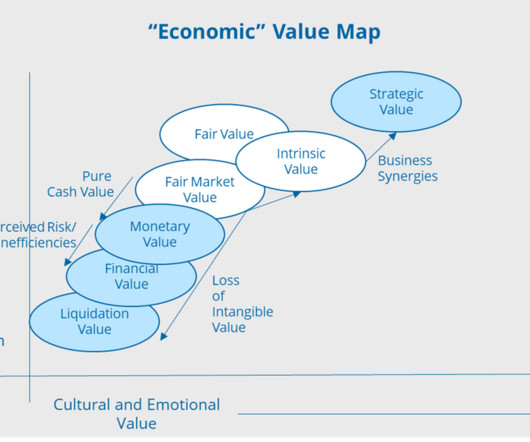

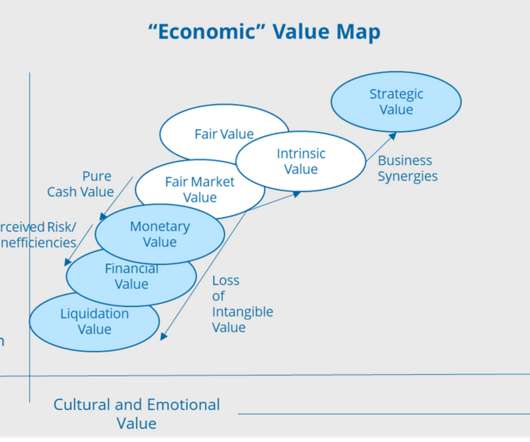

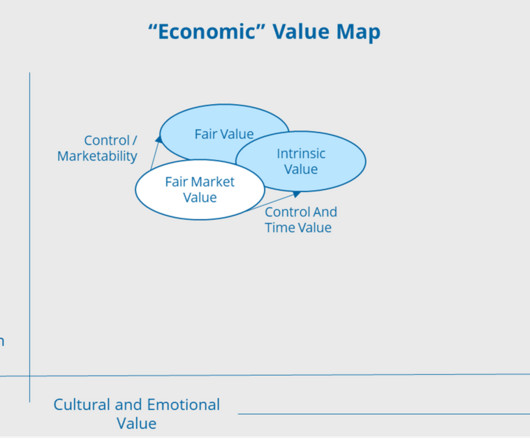

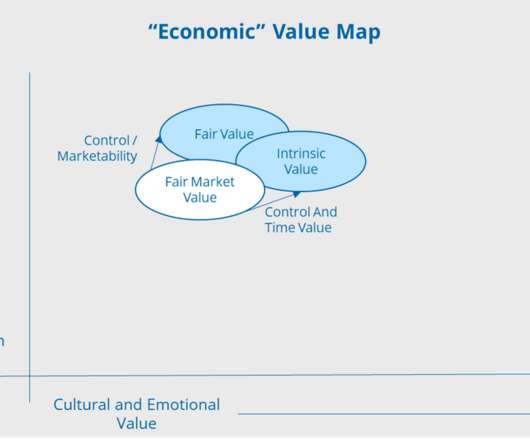

Under the Insolvency and Bankruptcy Code (IBC), 2016, valuation involves estimating both fair and liquidation values of a debtor’s assets to guide decision-making in the insolvency resolution process. As per IBBI norms, two registered valuers must be appointed to independently determine the asset values. You’re not alone.

Let's personalize your content