Financial Due Diligence: Understanding Both Perspectives

Benchmark Report

FEBRUARY 2, 2024

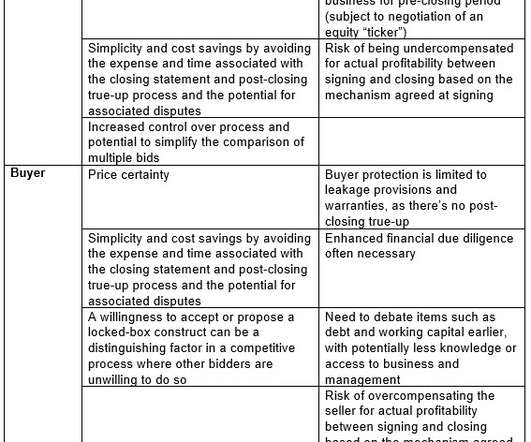

For buyers, the financial due diligence (FDD) exercise is a major fact-finding exercise that will, hopefully, reinforce the assumptions that have underpinned their offer. For both, it’s a pivotal exercise for informed decision-making, providing protection from unexpected risks and uncertainties.

Let's personalize your content