Data Update 6 for 2025: From Macro to Micro - The Hurdle Rate Question!

Musings on Markets

FEBRUARY 8, 2025

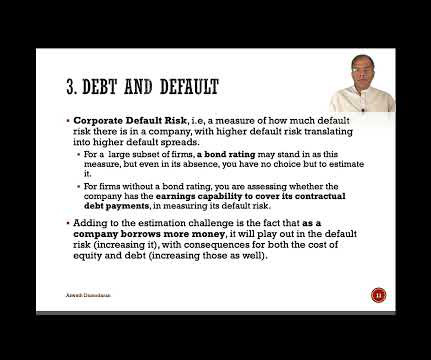

In the first five posts, I have looked at the macro numbers that drive global markets, from interest rates to risk premiums, but it is not my preferred habitat. A few years ago, I wrote a paper for practitioners on the cost of capital , where I described the cost of capital as the Swiss Army knife of finance, because of its many uses.

Let's personalize your content