Who Employs Your Doctor? Increasingly, a Private Equity Firm

NYT M&A

JULY 10, 2023

A new study finds that private equity firms own more than half of all specialists in certain U.S. markets.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

NYT M&A

JULY 10, 2023

A new study finds that private equity firms own more than half of all specialists in certain U.S. markets.

Harvard Corporate Governance

AUGUST 10, 2022

A wide range of research examines the market for CEOs and executive mobility in public companies while largely ignoring the market for CEOs in private equity funded companies. We augment the work on public company CEOs by studying the market for CEOs among larger U.S. times on its equity investment.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Benchmark Report

FEBRUARY 1, 2022

Louis-based private equity firm Compass Group Equity Partners. These meetings followed a uniquely short 15-day marketing campaign in which over 400 potential acquirers were approached. “In Benchmark International has successfully brokered the sale of Wilnat, Inc. doing business as KGM) to St.

Mckinsey and Company

NOVEMBER 1, 2022

Institutional investors and private equity firms can implement some basic but crucial best practices to measure progress on diversity, equity, and inclusion.

The Guardian M&A

FEBRUARY 22, 2023

Apollo has until 22 March to announce a firm intention to make a takeover offer or walk away The Aberdeen-based energy services and consulting firm John Wood Group has rejected three takeover approaches from Apollo Global Management, in the latest private equity raid on a UK company.

Brian DeChesare

JUNE 29, 2022

If you’re thinking about exit opportunities and can’t decide between private equity and hedge funds , activist hedge funds might be your solution. Similar to private equity firms, they operate on longer time frames, influence companies’ operations and finances, and might catalyze major changes, such as spin-offs or acquisitions.

Erik A. Lopez

OCTOBER 26, 2015

He and the Merit Harbor team work with middle-market business owners looking to grow, acquire or sell companies in the $10mm to $100mm valuation range. It wasn’t too long ago when private equity firms had the power – and ability – to do very little heavy lifting in order to enjoy a substantial growth on their return in a short period of time.

Benzinga

APRIL 4, 2022

who has been credited for coining the business term "market share" Originally called the AC Nielsen Company, it was the first company to offer market research. Nielsen's retail index, the first of its kind, allowed companies to determine their 'share' of the market. Nielsen Sr.,

Mckinsey and Company

NOVEMBER 13, 2023

As private equity firms enhance their approaches to diversity, equity, and inclusion, many still struggle to close important parity gaps.

Financial Times M&A

JULY 24, 2022

Abu Dhabi sovereign wealth fund will also buy stake after market turmoil made a listing or external sale more difficult

Brian DeChesare

MARCH 13, 2024

Over the past few decades, growth equity (GE) has gone from an afterthought to a major asset class for huge investment firms. Others would counter that growth equity’s rapid ascent was mostly due to the easy money that persisted between 2008 and 2021. The Top Growth Equity Firms Why Did Growth Equity Get So Popular?

Brian DeChesare

NOVEMBER 1, 2023

When you hear the words “healthcare private equity,” two thoughts probably come to mind: Wait a minute, isn’t healthcare a risky/growth-oriented sector? Why do PE firms operate there? In most of the world, healthcare is either government-run or a mixed public/private sector.

Benchmark Report

JANUARY 24, 2022

Private equity transactions on a global scale returned to form in 2021 following the challenges posed by the pandemic, with private equity firms deploying record amounts of dry powder held as they looked to invest cash accumulated during the pandemic. These include:

John Jenkins

APRIL 17, 2023

Not surprisingly, this environment has caused private equity firms to find ways to bridge valuation gaps in order to get deals done. The macroeconomic headwinds that dealmakers faced in 2022 have carried over into this year, and the recent unpleasantness in the banking sector threatens to make deal financing terms even tighter.

Class VI Partner

JANUARY 23, 2024

A post-pandemic slowdown in deal volumes and the rising cost of debt changed the dynamics for companies headed to market for capital formation transactions and buy-outs.The news is not altogether bleak. Private equity firms alone are sitting on nearly $900 billion in dry powder… Source

Mckinsey and Company

AUGUST 22, 2023

Private equity firms and institutional investors have intensified their focus on gender and ethnic diversity, but the road ahead remains long.

Private Funds CFO

JANUARY 18, 2022

Business development is proving to be a key role as market activity heats up.

Brian DeChesare

JANUARY 24, 2024

Let’s start with the elephant in the room: yes, we’ve covered the growth equity case study before, but I’m doing it again because I don’t think the previous examples were great. So, you can think of this example and tutorial as “Growth Equity Case Study: The Final Form.” They over-complicated the financial model (e.g.,

Financial Times M&A

JULY 6, 2022

Plus, Brookfield weathers an uncertain property market and the Church of England puts its faith in bonds

Auto Dealer Valuation Insights

APRIL 1, 2024

The Fed’s efforts to rein in inflation from early 2022 through the middle of 2023 also reined in middle market M&A activity. Middle market transaction data provider GF Data reported data on 269 sub-$500 million acquisitions by private equity firms in 2023, compared to 464 such deals in 2021 (a 42% decrease).

Business Wire M&A

APRIL 5, 2023

BOSTON--(BUSINESS WIRE)--Audax Private Equity (“Audax”), a leading alternative investment manager and capital partner for North American middle market companies, announced the acquisition of Krayden, Inc. Audax acquired Krayden from Charlottesville, VA-based private equity firm Quad-C Management.

Class VI Partner

JANUARY 23, 2024

A post-pandemic slowdown in deal volumes and the rising cost of debt changed the dynamics for companies headed to market for capital formation transactions or buy-outs.The news is not altogether bleak. Private equity firms alone are sitting on nearly $900 billion in dry powder… Source

Business Wire M&A

MAY 4, 2023

NEW YORK--(BUSINESS WIRE)-- #ITindustry--One Equity Partners (“OEP”), a middle market private equity firm, today announced that it has completed the simultaneous acquisitions of Kirey Group, an Italian IT systems integrator and proprietary technology solutions developer, and Synergyc, a Bulgarian IT services solutions provider.

Class VI Partner

JANUARY 23, 2024

A post-pandemic slowdown in deal volumes and the rising cost of debt changed the dynamics for companies headed to market for capital formation transactions or buy-outs.The news is not altogether bleak. Private equity firms alone are sitting on nearly $900 billion in dry powder… Source

Law 360 M&A

NOVEMBER 20, 2023

The Federal Trade Commission's recent complaint against a private equity firm's acquisition of anesthesiology practices highlights the controversial issue of cross-market harm in health care provider mergers, and could provide important insights into how a court may view such theories of harm, say Christopher Lau and Dina Older Aguilar at Cornerstone (..)

Harvard Corporate Governance

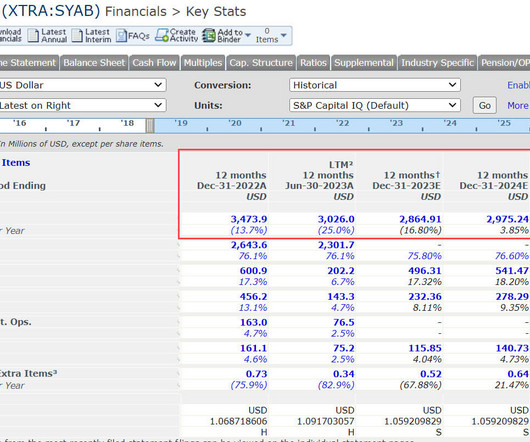

FEBRUARY 7, 2024

It was the first year since 2013 that the M&A market failed to hit the $3 trillion value mark, with continued reduced deal activity from private equity firms, which spent 36% less on acquisitions than in 2022. The M&A Environment in 2024 Global deal value in 2023 fell to the lowest level seen in a decade.

Benchmark Report

JANUARY 27, 2023

Louis-based private equity firm Compass Group Equity Partners. The coveted "Private Equity Deal of the Year for the Americas" was awarded at this month's 14th Annual M&A Americas Atlas Awards at Manhattan's Metropolitan Club.

Benchmark Report

MARCH 13, 2023

2023 holds a positive outlook for middle-market business valuations. The annual survey polls 400 leaders of US middle-market companies with $50 million to $1 billion in revenue and private equity firms actively buying and selling companies in the same revenue range.

Financial Times M&A

OCTOBER 31, 2022

Private equity firm teams up with sovereign wealth funds in buyout of US conglomerate’s climate tech arm

Law 360 M&A

FEBRUARY 1, 2024

Rise Growth Partners, advised by Kilpatrick Townsend & Stockton LLP, said Thursday it had received a $250 million investment from middle-market private equity firm Charlesbank Capital Partners, led by Simpson Thacher & Bartlett LLP, that will be used to acquire minority stakes in registered investment adviser firms.

Benzinga

JANUARY 11, 2024

DocuSign Inc (NASDAQ: DOCU ) shares surged in afternoon trading Thursday following a report suggesting multiple private equity firms are competing to acquire the company. The pair of firms are the final bidders in an.

Reynolds Holding

MARCH 12, 2024

Department of Health and Human Services announced that they are seeking public comment on private equity investment in the healthcare sector. The announcement coincided with the FTC’s workshop, Private Equity, Public Impact: An FTC Workshop on Private Equity in Health Care.

Reynolds Holding

AUGUST 14, 2023

It is de rigueur to label everything as sustainable – including in private equity. In a new working paper, we examine the claims of the top 100 private equity firms in the United States as to their committment to ESG. These firms represent more than $1.5 Six percent of PE firms have a dedicated ESG fund.

Business Wire M&A

APRIL 3, 2023

Architect acquired a majority interest in SNS from Datalogic, a listed Italian Group leader in the automation industry, as a carve-out ac

Harvard Corporate Governance

AUGUST 14, 2022

Dry powder is partially fueling these transactions as private equity firms compete to buy the best companies at the best prices, pushing them to look at the public markets for inspiration.

Benzinga

JANUARY 19, 2024

The company inked a pact to be acquired by private equity firm Arcline Investment Management in an all-cash transaction with a total enterprise value of approximately $1.8 Kaman, and headquartered in Bloomfield, Connecticut, conducts business in the aerospace & defense, industrial and medical markets.

Benzinga

FEBRUARY 12, 2024

12, 2024 (GLOBE NEWSWIRE) -- Transom Capital Group ("Transom"), an operations-focused middle market private equity firm, is acquiring Webasto Charging Solutions, Inc. LOS ANGELES, Feb. from Webasto Group, a top 100 supplier to the automotive industry worldwide.

Benzinga

SEPTEMBER 30, 2022

Workiva Inc (NYSE: WK ), a cloud application provider for reporting and compliance, attracted takeover interest from private equity firms. Thoma Bravo and TPG are among firms that have held financing discussions with direct lenders to support a potential transaction, Bloomberg reports. billion before.

Financial Times M&A

JUNE 20, 2022

European private equity firm acquires stakes in two leading insurers for $1.4bn

Accountancy Today

APRIL 11, 2024

Moore Kingston Smith Corporate Finance has advised Roycian on the £7m Management Buyout (MBO) of McAndrew Martin, an award-winning, independent multi-disciplinary design firm with projects in the UK, and a rapidly growing presence in international markets. McAndrew Martin was founded in 1989 by Bill McAndrew.

Benzinga

MAY 25, 2022

Bidders seeking to acquire Kohl's Corp (NYSE: KSS ) are likely to make offers lower than their initial ones to reflect the market downturn, Reuters reported. The potential purchasers, including private equity firm Sycamore Partners, brand holding firm Franchise Group, J.C.

Benzinga

DECEMBER 18, 2023

NYSE: AYX ) has agreed to be acquired by private equity firms Clearlake Capital Group, L.P., billion, including debt, to transition into a privately held entity. Alteryx, Inc. and Insight Partners for ~$4.4 Under the agreement, shareholders of Alteryx will receive a cash payment of $48.25 for each share.

ThomsonReuters

MARCH 13, 2023

These investments marked a notable transformation in the profession, with the realization among private equity firms that investing in large accounting firms can yield great returns. For firms looking to attract private equity investors, there are several factors to consider and ways to help draw appeal.

Scott Mashuda

MARCH 1, 2024

Stepping into 2024, Lower Middle Market (LMM) M&A dynamics continue to evolve. With strategic acquirers continuing to seek growth opportunities and private equity firms eyeing add-on opportunities – coupled with ample investable capital – there’s a heightened demand for quality LMM companies.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content