Good Intentions, Perverse Outcomes: The Impact of Impact Investing!

Musings on Markets

OCTOBER 12, 2023

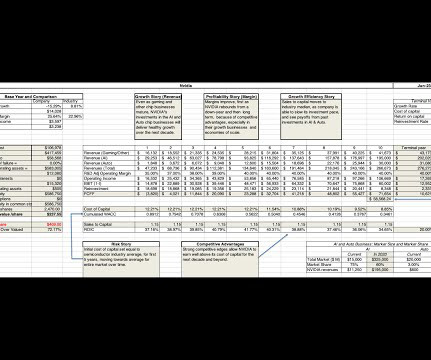

On the alternative energy front, as money has flowed into these companies, there has been a surge in enterprise value (equity and net debt) and market capitalization (equity value); I report both because impact investing can also take the form of green bonds, or debt, at these companies.

Let's personalize your content