Sony in Talks to Join a Bid to Buy Paramount

NYT M&A

APRIL 18, 2024

The company and Apollo Global Management are discussing a joint effort, even as Paramount conducts exclusive merger negotiations with Skydance.

NYT M&A

APRIL 18, 2024

The company and Apollo Global Management are discussing a joint effort, even as Paramount conducts exclusive merger negotiations with Skydance.

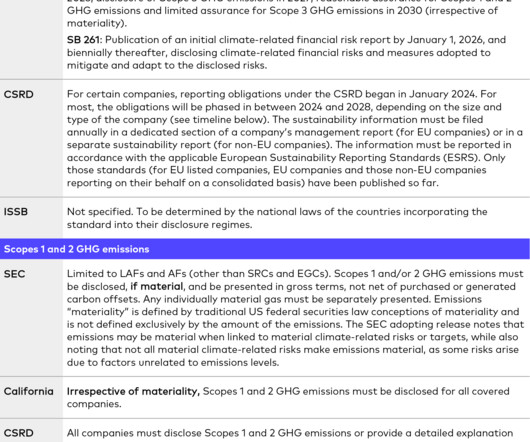

Harvard Corporate Governance

APRIL 15, 2024

Posted by Emma Bichet, Michael Mencher, Beth Sasfai, Cooley LLP, on Monday, April 15, 2024 Editor's Note: Emma Bichet and Michael Mencher are Special Counsels and Beth Sasfai is a Partner at Cooley LLP. This post is based on a Cooley memorandum by Ms. Bichet, Mr. Mencher, Ms. Sasfai, Jack Eastwood , and Charlotte Yin. The Securities and Exchange Commission (SEC) adopted its long-awaited climate disclosure rules on March 6, 2024.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Mckinsey and Company

APRIL 15, 2024

It’s hard to create outsize value when you have to manage the finance function’s daily and often urgent demands. But some CFOs rise to the challenge.

Benzinga

APRIL 19, 2024

Saudi Arabia's Manara Minerals is reportedly in advanced talks to acquire a minority stake in Pakistan’s Reko Diq gold and copper mine project. The project, located in the commodity-rich province of Balochistan , is on track to start production by 2028. According to Bloomberg and the state-run Radio Pakistan, the official announcement could come within a few weeks.

Speaker: Susan Spencer, Principal of Spencer Communications

Intent signal data can go a long way toward shortening sales cycles and closing more deals. The challenge is deciding which is the best type of intent data to help your company meet its sales and marketing goals. In this webinar, Susan Spencer, fractional CMO and principal of Spencer Communications, will unpack the differences between contact-level and company-level intent signals.

NYT M&A

APRIL 17, 2024

A new measure attempts to force the Senate’s hand on passing legislation to ban TikTok or mandate the app’s sale.

Harvard Corporate Governance

APRIL 16, 2024

Posted by Edna Twumwaa Frimpong and Dottie Schindlinger, Diligent Institute, and Derek Vadala, Bitsight, on Tuesday, April 16, 2024 Editor's Note: Edna Twumwaa Frimpong is Director of International Research and Dottie Schindlinger is Executive Director at Diligent Institute; and Derek Vadala is Chief Risk Officer at Bitsight. This post is based on a recent report by Ms.

Business Valuation Zone brings together the best content for business valuation professionals from the widest variety of industry thought leaders.

Financial Times M&A

APRIL 13, 2024

Britain falls to second most appealing European country to deploy capital, according to CBRE survey

NYT M&A

APRIL 18, 2024

Hipgnosis, which owns the rights to songs by Justin Bieber and Neil Young, helped kick-start a rush on catalog sales. But its future has been in doubt.

Harvard Corporate Governance

APRIL 15, 2024

Posted by Alexander I. Platt (University of Kansas School of Law), on Monday, April 15, 2024 Editor's Note: Alexander I. Platt is an Associate Professor at the University of Kansas School of Law. This post is based on his recent paper , forthcoming in the Washington Law Review. Two developments have transformed the detection of corporate fraud since the global financial crisis: the SEC whistleblower bounty program (WBP) and the rise of activist short sellers.

Mckinsey and Company

APRIL 15, 2024

Consumers are increasingly discerning about where, how, and from whom they receive healthcare. Healthcare can learn from other industries how to provide an optimal end-to-end consumer experience.

Speaker: Wayne Spivak - President and Chief Financial Officer of SBA * Consulting LTD, Industry Writer, and Public Speaker

The old adages that "cash is king" and "you can’t spend profits" still hold true today. But however well-known these sayings might be, it requires a change in mindset to properly implement a cash flow management system that predicts your business's runaway as accurately as possible. Key to this new mindset is understanding the difference between the Statement of Cash Flows, a historical look at the source and uses of cash, and the Cash Flow Statement, which uses transaction history and forward-l

Financial Times M&A

APRIL 14, 2024

How the Wallenberg family helped turn EQT Partners into a colossus of the buyout industry

Trout CPA

APRIL 19, 2024

At Trout CPA, we take immense pride in the dedication and expertise of our team members. Earlier this year, we proudly announced that Senior Associate Aaron Fleitman had earned his AM (Accredited Member) designation from the esteemed American Society of Appraisers. Building upon this achievement, we are delighted to announce further his attainment of the Accredited Senior Appraiser (ASA) designation from the American Society of Appraisers.

Harvard Corporate Governance

APRIL 14, 2024

Posted by Matt DiGuiseppe, Maria Castañón Moats, and Paul DeNicola, PricewaterhouseCoopers LLP, on Sunday, April 14, 2024 Editor's Note: Matt DiGuiseppe is Managing Director, Maria Castañón Moats is Leader, and Paul DeNicola is Principal at the Governance Insights Center, PricewaterhouseCoopers LLP. This post is based on their PwC memorandum. As we gear up for the 2024 proxy season, it’s important to temper our expectations for any major surprises.

Mckinsey and Company

APRIL 15, 2024

Five actions can transform an organization’s talent system, establishing a culture of performance while boosting employee experience.

Speaker: Joe Apfelbaum, CEO of Ajax Union

In this webinar, Joe Apfelbaum, CEO of Ajax Union and business strategist, will take you through the ABCs of intent data. You'll learn how to effectively use it to drive business results, with practical tips on how to leverage both company and contact intent data to maximize your marketing efforts. Whether you're a seasoned marketer or just getting started, this webinar is a must-attend for anyone looking to stay ahead in the ever-evolving world of digital marketing.

N Contracts

APRIL 16, 2024

Vendors make promises. They say they’ll comply with applicable laws and regulations and that their security controls are impenetrable. They swear they’ll never violate the terms of their contract. But is that really what’s going to happen?

JPAbusiness

APRIL 16, 2024

Succession planning is about protecting your business against the risk of failure should key people - including yourself - leave. People often confuse the practice of business ‘succession planning’ with ‘retirement planning’. They are, of course, very different concepts. Succession planning is a valuable activity for any business, at any stage , regardless of whether the owner is considering retiring, selling or staying with the business for many years to come.

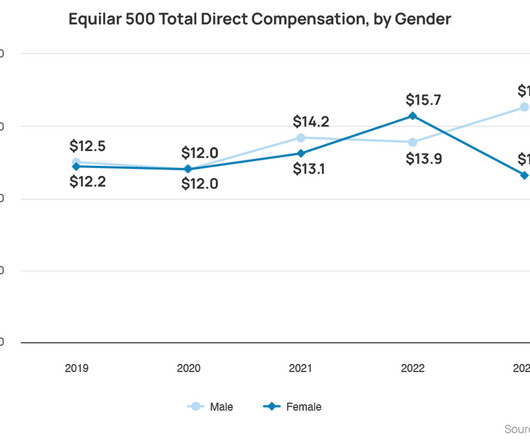

Harvard Corporate Governance

APRIL 18, 2024

Posted by Joyce Chen and Courtney Yu, Equilar, Inc., on Thursday, April 18, 2024 Editor's Note: Joyce Chen is Associate Editor and Courtney Yu is Director of Research at Equilar, Inc. This post was prepared for the Forum by Ms. Chen and Mr. Yu. The 2024 proxy season is in full swing, as public companies are in the process of submitting their proxy statements (DEF14A) to the Securities and Exchange Commission (SEC) ahead of annual shareholder meetings.

Mckinsey and Company

APRIL 16, 2024

Innovative business models in US healthcare are creating substantial value, but much opportunity remains, even among the fastest-growing organizations.

Machen McChesney

APRIL 16, 2024

If your business doesn’t already have a retirement plan, it might be a good time to take the plunge. Current retirement plan rules allow for significant tax-deductible contributions.

Benchmark Report

APRIL 16, 2024

Benchmark International is pleased to announce the successful sale of BitCo Telecoms, a leading provider of business wireless and voice over IP solutions, to Link Africa, one of the leading cost-effective independent fibre network operators in South Africa

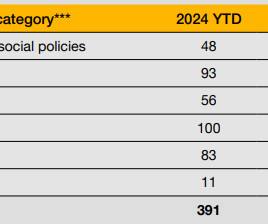

Harvard Corporate Governance

APRIL 16, 2024

Posted by Ali Saribas and Carmen Ng, SquareWell Partners, on Tuesday, April 16, 2024 Editor's Note: Ali Saribas is a Partner, and Carmen Ng is a Director at SquareWell Partners. This post is based on their SquareWell memorandum. i. Introduction SquareWell published the inaugural edition of “ What do Shareholders Propose “, a comprehensive review of all shareholder proposals related to environmental, social, and governance (“ESG”) topics in Europe and the United States for 2022 and 20

Mckinsey and Company

APRIL 18, 2024

Decarbonization has emerged as a critical tool in the fight against climate change, but it also shows promise as a means of economic acceleration across the globe. Learn how.

Benzinga

APRIL 17, 2024

Flora Growth Corp. (NASDAQ: FLGC ) has entered into a definitive agreement to acquire all of the issued and outstanding shares of Germany-based TruHC Pharma GmbH. The company’s latest move to further cement its global footprint comes on the heels of a new German cannabis law that went into effect on April 1, which partially legalizes cannabis by allowing adults over 18 to possess up to 25 grams of dried cannabis and grow three marijuana plants at home.

Butcher Joseph & Co.

APRIL 15, 2024

ButcherJoseph Advises ITR Economics on Its Sale to Crowe. The post ButcherJoseph Advises ITR Economics on Its Sale to Crowe appeared first on ButcherJoseph & Co.

Harvard Corporate Governance

APRIL 16, 2024

Posted by Jun Qian (Fudan University), on Tuesday, April 16, 2024 Editor's Note: Jun Qian (QJ) is Professor of Finance and Executive Dean at the Fanhai International School of Finance (FISF), Fudan University. This post is based on a forthcoming article in the Journal of Finance by Franklin Allen , Professor Qian, Chenyu Shan , and Julie Lei Zhu. The Chinese stock market started in 1990 with the establishment of two domestic stock exchanges (the “A share” market): the Shanghai Stock Exchange (SS

Mckinsey and Company

APRIL 18, 2024

Momentum for the battery cell component market is building rapidly in Europe and North America. To capitalize on this opportunity, suppliers will need to tackle several challenges head-on.

Gross Mendelsohn

APRIL 19, 2024

For a couple going through a divorce, there are many things to plan for. If there are children involved, custody issues can become extremely contentious. Spouses have been known to use their children as bargaining chips to try to “win” during the divorce. But what if one of the “children” in the marriage is a business? What happens when that business is used to try to “win”?

NYT M&A

APRIL 17, 2024

Regulators are expected to meet next week to discuss the $8.5 billion deal between Coach’s owner, Tapestry, and Michael Kors’ parent company, Capri Holdings, which would create a U.S. luxury conglomerate.

Harvard Corporate Governance

APRIL 17, 2024

Posted by Danielle Gurrieri and Chuck Callan, Broadridge, on Wednesday, April 17, 2024 Editor's Note: Danielle Gurrieri is Vice President Head of Product Management-Bank, Broker Dealer and Chuck Callan is SVP of Regulatory Affairs at Broadridge. This post is based on their Broadridge memorandum. This proxy season, some of the world’s biggest fund managers are launching or expanding pass-through voting programs to give their fund investors a say on how shares of portfolio companies are voted.

Mckinsey and Company

APRIL 18, 2024

The demand for nature and biodiversity investments is growing—Saker Nusseibeh talks about how to meet clients where they are and encourage them to move forward with a long-term view.

Butcher Joseph & Co.

APRIL 16, 2024

ButcherJoseph & Co. Vice President Tristan Tahmaseb’s article “Winning M&A Strategies During Tough Market Conditions” as featured in the Associa. The post Tristan Tahmaseb Featured in ACG’s Middle Market Growth appeared first on ButcherJoseph & Co.

Financial Times M&A

APRIL 17, 2024

Co-working group is seeking hundreds of millions of dollars to exit bankruptcy without a sale

Harvard Corporate Governance

APRIL 19, 2024

Posted by Usha Rodrigues (University of Georgia), on Friday, April 19, 2024 Editor's Note: Usha Rodrigues is the M.E. Kilpatrick Chair of Corporate Finance and Securities Law at the University of Georgia School of Law. This post is based on her SSRN working paper. In the Hidden Logic of Shareholder Democracy , I examine the basic rules of shareholder voting.

Mckinsey and Company

APRIL 15, 2024

When we become too comfortable in our jobs and relationships, we can miss huge opportunities to grow and change. Harvard University professor Cass Sunstein explores this dynamic—and suggests ways to keep the sparkle in our lives.

Let's personalize your content