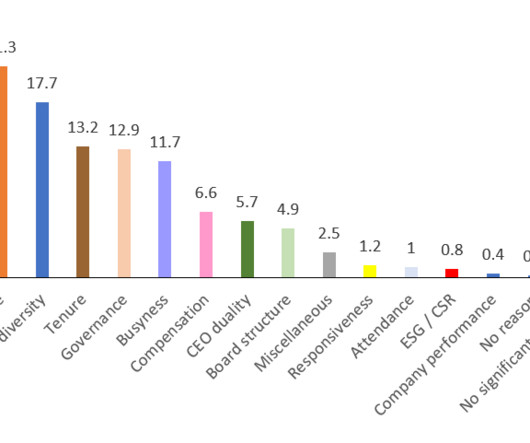

Voting Rationales

Harvard Corporate Governance

AUGUST 23, 2023

Posted by Roni Michaely (The University of Hong Kong), Silvina Rubio (University of Bristol Business School), and Irene Yi (University of Toronto), on Wednesday, August 23, 2023 Editor's Note: Roni Michaely is a Professor of Finance and Entrepreneurship at The University of Hong Kong, Silvina Rubio is an Assistant Professor of Finance at the University of Bristol, and Irene Yi is an Assistant Professor of Finance at the University of Toronto.

Let's personalize your content