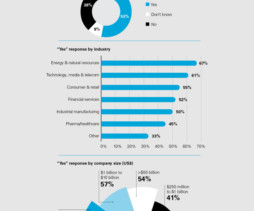

Global Compliance Risk Benchmarking Survey: ESG

Harvard Corporate Governance

JULY 25, 2023

Posted by Darryl Lew (White & Case LLP), Courtney Hague Andrews (White & Case LLP) and Joshua W. Rusenko (KPMG LLP), on Tuesday, July 25, 2023 Editor's Note: Darryl Lew and Courtney Hague Andrews are Partners at White & Case LLP and Joshua W. Rusenko is an Attorney at KPMG LLP. This post is based on a White & Case survey in collaboration with KPMG by Mr.

Let's personalize your content