How Did the Pandemic Impact EBITDA Multiples in 2020? Explore a 12-Month Snapshot in the DealStats Value Index

BVR

MARCH 28, 2022

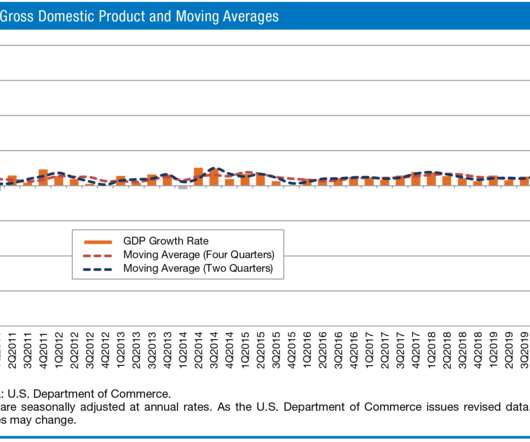

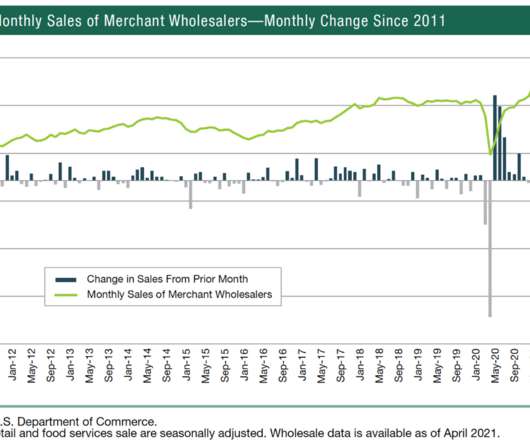

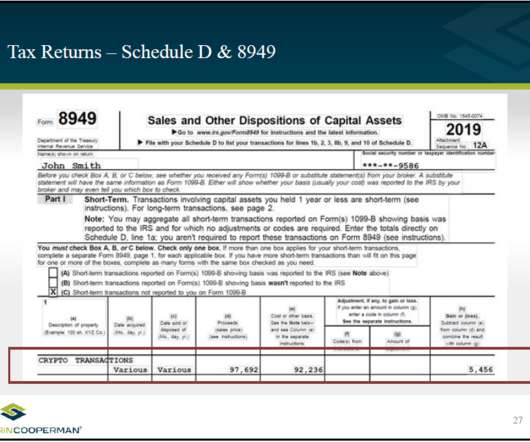

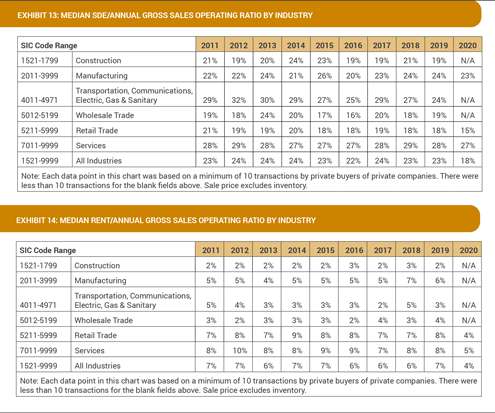

With the COVID-19 pandemic putting a stranglehold on the U.S. economy for most of 2020 and causing an unprecedented economic impact on small businesses, DealStats Value Index (DVI) captured the 12-month snapshot on how earnings before interest, taxes, depreciation, and amortization (EBITDA) multiples have trended.

Let's personalize your content