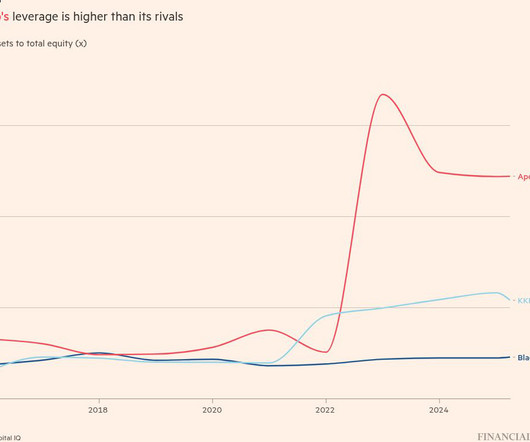

Barbarians flee the floodgates

Financial Times M&A

JUNE 3, 2025

Plus, how private equitys big three diverged and quant fund titan Cliff Asness on how hes embraced AI

Financial Times M&A

JUNE 3, 2025

Plus, how private equitys big three diverged and quant fund titan Cliff Asness on how hes embraced AI

Mckinsey and Company

JUNE 3, 2025

Many value chains need to collaborate to create low-carbon, circular materials for complex products. This overview offers a guide on where to start for materials producers and downstream customers.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Global Finance

JUNE 3, 2025

The North African kingdom has adapted quickly to the digital age. In 2020, the Agency for Digital Development published a roadmap listing digital infrastructure as a priority. Since then, incentives have been put in place for the sector, including tax cuts and exemptions in the National Charter of Investment. The desire for data sovereignty has also contributed to the boom in data centers.

Mckinsey and Company

JUNE 3, 2025

Increasing circularity in copper could significantly lower emissionsbut first, the industry will need to capture uncollected copper scrap.

Speaker: Susan Spencer, Principal of Spencer Communications

Intent signal data can go a long way toward shortening sales cycles and closing more deals. The challenge is deciding which is the best type of intent data to help your company meet its sales and marketing goals. In this webinar, Susan Spencer, fractional CMO and principal of Spencer Communications, will unpack the differences between contact-level and company-level intent signals.

Global Finance

JUNE 3, 2025

This change will open the market to fintechs and digital banks, which is expected to increase market competition and, possibly, bank consolidations as small banks are forced to merge or exit the industry. “Fintechs will drive innovation in the sector, prompting traditional banks to adopt new technologies to stay competitive,” says Anne Kibisu, a banking analyst at Deloitte Kenya.

Mckinsey and Company

JUNE 3, 2025

Decarbonizing the glass industry would have a widespread beneficial effect across industriesbut first, companies need to gain insight into which levers are feasible and how to scale them.

Business Valuation Zone brings together the best content for business valuation professionals from the widest variety of industry thought leaders.

Financial Times M&A

JUNE 3, 2025

UKs largest utility at risk of nationalisation after KKR walked away from 4bn rescue deal

Global Finance

JUNE 3, 2025

To enhance their competitive advantage, they are placing a growing emphasis on innovation and driving business growth. The findings come as artificial intelligence (AI) is emerging as a crucial technology for banks, and demand for the technology is expected to become fierce. Strategic priorities have shifted European banks are shifting strategic priorities from reducing costs to innovation and growth.

Mckinsey and Company

JUNE 3, 2025

Decarbonizing and building circularity into plastics will require alignment across the entire plastics value chain.

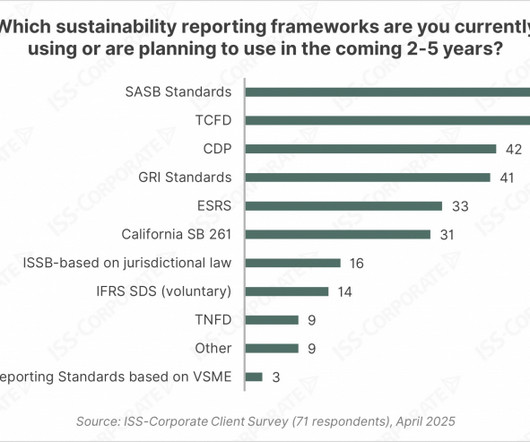

Harvard Corporate Governance

JUNE 3, 2025

Posted by Subodh Mishra, ISS STOXX, on Tuesday, June 3, 2025 Editor's Note: Subodh Mishra is Global Head of Communications at ISS STOXX. This post is based on an ISS-Corporate memorandum by Kosmas Papadopoulos, Executive Director & Head of Sustainability Advisory for the Americas at ISS-Corporate. Streamlining Sustainability Reporting: Survey Reveals Top Priorities for Corporates Sustainability reporting has become widespread and increasingly complex, as corporate issuers manage stakeholder

Speaker: Wayne Spivak - President and Chief Financial Officer of SBA * Consulting LTD, Industry Writer, and Public Speaker

The old adages that "cash is king" and "you can’t spend profits" still hold true today. But however well-known these sayings might be, it requires a change in mindset to properly implement a cash flow management system that predicts your business's runaway as accurately as possible. Key to this new mindset is understanding the difference between the Statement of Cash Flows, a historical look at the source and uses of cash, and the Cash Flow Statement, which uses transaction history and forward-l

Mckinsey and Company

JUNE 3, 2025

A healthy culture can triple a corporate ventures TSR by defining underlying beliefs, focusing on leadership, and modeling and celebrating desired behavior.

Harvard Corporate Governance

JUNE 3, 2025

Posted by Rustam Abuzov (University of Virginia), Will Gornall (University of British Columbia), and Ilya A. Strebulaev (Stanford University), on Tuesday, June 3, 2025 Editor's Note: Rustam Abuzov is an Assistant Professor of Finance at the Darden School of Business, University of Virginia, Will Gornall is an Associate Professor of Finance at UBC Sauder School of Business, and Ilya A.

Appraisers Blog

JUNE 3, 2025

We’re already working for fees from the 1980’s or 90’s I was doing duplexes for $450=$500 in the 1980’s and can’t even get that today. Do any of you guys actually think that they will pay us more for this new requirement? They’ll probably try to push fees down even further and get waivers on even more. I hope I’m wrong, but I’m not holding my breath.

Mckinsey and Company

JUNE 3, 2025

The digital workforce is happening. Heres what it may look like when humans are working side by side with AI agentsand how to prepare now for this surprisingly near-term eventuality.

Speaker: Joe Apfelbaum, CEO of Ajax Union

In this webinar, Joe Apfelbaum, CEO of Ajax Union and business strategist, will take you through the ABCs of intent data. You'll learn how to effectively use it to drive business results, with practical tips on how to leverage both company and contact intent data to maximize your marketing efforts. Whether you're a seasoned marketer or just getting started, this webinar is a must-attend for anyone looking to stay ahead in the ever-evolving world of digital marketing.

Appraisers Blog

JUNE 3, 2025

In reply to cl. It is simply assumed by the woke regulation types that we ARE biased regardless of the lack of evidence and the reality that 99.99999999999% of us don’t even think about the races of people involved in what we do. And, of course, the people who provide appraiser education can create another useless course, make it mandatory and charge us for it.

Financial Times M&A

JUNE 3, 2025

Nonbinding vote comes as entertainment groups stock has fallen sharply since its formation in a 2022 merger

Machen McChesney

JUNE 3, 2025

In the hiring process, you must ensure that every individual you plan to employ is authorized to accept employment in the U.S. Some individuals are automatically authorized to work based on their immigration status , while others must apply for separate employment authorization.

JPAbusiness

JUNE 3, 2025

Small businesses (u nder 100 employees ) are particularly vulnerable to fraud , as limited staff numbers means there are fewer checks and balances, and less segregation of dutie s. [ S ource: ACFE O ccupational Fraud 2024: A Report to the Nations ] But there are things small to mid-sized business owners and managers can do to limit opportunities to commit employee crimes and create a work environment that actively discourages fraud.

Mckinsey and Company

JUNE 3, 2025

Global capability centers are becoming places of enterprise-wide innovation, changing companies services and workforces as they adopt and benefit from new technologies.

Butcher Joseph & Co.

JUNE 3, 2025

St. Louis-based Packing Concepts Makes the Transition to an ESOP. The post St. Louis Business Journal: Packaging Concepts’ Journey to Employee Ownership appeared first on ButcherJoseph & Co.

Mckinsey and Company

JUNE 3, 2025

Sharpen your problem-solving skills the McKinsey way, with our weekly crossword. Each puzzle is created with the McKinsey audience in mind, and includes a subtle (and sometimes not-so-subtle) business theme for you to find. Answers that are directionally correct may not cut it if youre looking for a quick win.

Butcher Joseph & Co.

JUNE 3, 2025

Jake Johnston Named Emerging Leader by M&A Advisor. The post The M&A Advisor Announced Jake Johnston as Recipient of 16th Annual Emerging Leaders Awards appeared first on ButcherJoseph & Co.

Financial Times M&A

JUNE 3, 2025

Proof of a renewed appetite for dealmaking could help the Hong Kong conglomerate realise value trapped in its other divisions

Scott Mashuda

JUNE 3, 2025

FOR IMMEDIATE RELEASE: REAG announces the promotion of M&A expert Jaclyn Ring to Director, recognizing her leadership excellence and contributions to lower middle market transactions. PITTSBURGH, PA June 2, 2025 – REAG, a leading investment banking firm specializing in mergers and acquisitions and private capital market advisory services in the lower middle market, today announced the promotion of Jaclyn Ring from Vice President to Director.

Lighter Capital

JUNE 3, 2025

For SaaS founders, especially those balancing growth and capital efficiency, VC 3.0 presents both challenges and abundant opportunities. Find out what VC 3.0 is, how fundraising has changed, and what founders need to know to adapt and succeed.

Law 360 M&A

JUNE 3, 2025

A Washington federal judge on Tuesday refused to stop Redfin shareholders from voting Wednesday on a $1.75 billion merger with Rocket Cos., finding that with new disclosures made by the company, investors have enough information to make an informed decision.

Auto Dealer Valuation Insights

JUNE 3, 2025

The month is June, the windows in the car are rolled down, and “School’s Out” by Alice Cooper is playing. Summer of 2025 is here, and it should be a hot one. Outside, of course, but what about the U.S. economy? In 2025, the S&P 500 is up roughly 1% to date, recovering from what was a 15% year-to-date decrease in early April.

Law 360 M&A

JUNE 3, 2025

Belgian real estate investment trusts Aedifica NV and Cofinimmo NV said Tuesday they have agreed to merge, forming what they said will be Europe's largest healthcare real estate investment trust, with a combined gross asset value of approximately 12.1 billion ($13.8 billion).

Benzinga

JUNE 3, 2025

On Tuesday, Alto Neuroscience, Inc. (NASDAQ: ANRO ) announced an asset purchase agreement with Chase Therapeutics Corporation for a portfolio of dopamine agonist drug combinations for treatment-resistant depression (TRD), generally defined as a failure on two or more antidepressants. Alto paid Chase Therapeutics an upfront payment of $1.75 million. Chase Therapeutics will be eligible for up to $71.5 million in milestone payments, $41 million of the potential future milestone payments are tied to

Law 360 M&A

JUNE 3, 2025

U.S.-German biopharmaceutical company atai Life Sciences, advised by Latham & Watkins LLP, said in an announcement Monday that it will acquire Beckley Psytech, led by Mayer Brown LLP and CMS Cameron McKenna Nabarro Olswang LLP, in an all-share transaction that values Beckley at approximately $390 million, creating a combined company focused on fast-acting mental health therapies.

N Contracts

JUNE 3, 2025

Explore how policies and governance work together and practical steps to create clear, actionable policies that support accountability.

Law 360 M&A

JUNE 3, 2025

23andMe and Canadian customers suing over a data breach agreed on Tuesday to pause lawsuits against non-bankrupt third parties for up to six months amid the DNA testing company's Chapter 11 proceedings in Missouri.

Peak Business Valuation

JUNE 3, 2025

The essential oil industry is growing as more people turn to natural products for health and wellness. These oils are used in skincare, cleaning, aromatherapy, and other everyday items. Because of this demand, buying an essential oil business can be a smart investment. If you plan to buy an essential oil business, a business valuation is key as a business owner.

Law 360 M&A

JUNE 3, 2025

T-Mobile, AT&T and Verizon appear to be coordinating to split UScellular among themselves and the Federal Communications Commission needs to review the megadeals in their totality and not just individually, public interest groups said.

Let's personalize your content