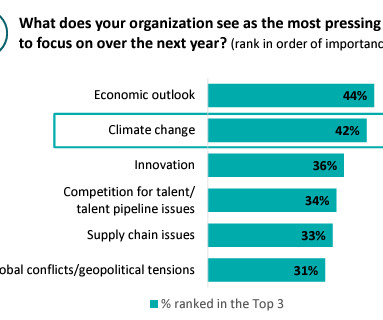

2023 CxO Sustainability Report

Harvard Corporate Governance

JANUARY 2, 2024

Posted by Joe Ucuzoglu and Jennifer Steinmann, Deloitte Touche Tohmatsu Limited, on Tuesday, January 2, 2024 Editor's Note: Joe Ucuzoglu is Global CEO and Jennifer Steinmann is Global Sustainability & Climate Practice Leader at Deloitte Touche Tohmatsu Limited. This post is based on their Deloitte memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here ) by Lucian A.

Let's personalize your content